The Specialty Coffee Transaction Guide’s latest version collects contract data from 81 roasters, importers, exporters, cooperatives, and producers from 20 different countries.

BY CHRIS RYAN

BARISTA MAGAZINE ONLINE

Images courtesy of Specialty Coffee Transaction Guide

At the end of 2018, a new tool—called the Specialty Coffee Transaction Guide—emerged to capture how much is being paid for specialty coffee. The inaugural guide did this by collecting free-on-board (FOB) green specialty coffee prices from the 2016-17 and 2017-18 harvests from 21 roasters and importers who acted as “data donors.” (FOB stands for “free on board,” which is the price paid upon exporting from the country where a coffee was produced.)

A year later, the guide returned in expanded form, with nearly 60 data donors providing their numbers to paint a picture of how much roasters are paying for coffee. The guide’s intention is to provide an alternative price gauge to the coffee commodity market (or C market), which often results in farmers being paid less than the cost of production. The prices in the guide account for the specialty market, and the guide ideally offers benchmark prices that exceed producers’ costs of production, giving these producers a more accurate idea of what their coffee is worth.

Now, with the conclusion of 2020 and the onset of the new year, the Specialty Coffee Transaction Guide has released its third edition—and with it, the project has again expanded its scope. The 2020 version uses contract data from 81 roasters, importers, exporters, cooperatives, and producers headquartered in 20 different countries. These data summarize 51,000 contracts that cover roughly 1.09 billion pounds of green specialty coffee valued at more than $2.1 billion. The guide can be downloaded for free here.

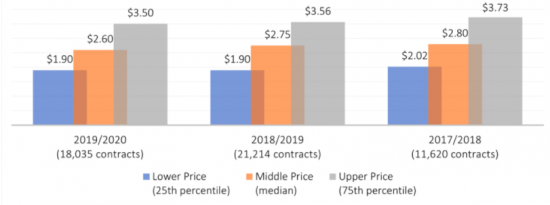

The 2020 guide found that the median FOB price for green specialty coffees fell from $2.75 per pound in the 2018/2019 harvest year to $2.60 per pound in 2019/2020. According to a press release announcing the new guide, “This price decline was due to a shift away from higher-quality ‘fancy’ coffees and toward higher-volume ‘regular’ specialty coffees. Lower (i.e., 25th percentile) FOB prices held steady at $1.90 per pound while higher (i.e., 75th percentile) prices fell $0.06 to $3.50 in the 2019/2020 harvest.”

As with previous editions, the main actors behind the Specialty Coffee Transaction Guide are Peter W. Roberts of Transparent Trade Coffee (TTC), an organization funded by the Goizueta Business School at Emory University in Atlanta, and Chad Trewick of Reciprocafé LLC, a consultancy focused on encouraging transparency within the coffee value chain.

Chad says that with the 81 data donors for the new edition—compared to 57 in the previous edition—he conservatively estimates that 6-7% of specialty coffee bought and sold is now captured in the guide. “More data mean that each version of the Transaction Guide is increasingly representative of industry selling and buying behaviors,” Chad says. “In other words, with more data to analyze, we have a better picture of how coffees in the specialty coffee market are priced.”

Peter adds that while it is more challenging to gather and process data from a higher number of sources, it is a challenge the Transaction Guide team welcomes—as Chad puts it, “more data means greater legitimacy,” and this information helps illustrate the price crisis that puts the supply of green coffee in jeopardy and threatens the livelihoods of millions of coffee producers globally.

Chad continues, “As our information becomes more representative and legitimate, we look to organizations genuinely concerned with supporting the coffee-producing sector to begin to use the information in the Transaction Guide, for systematic comparisons against widely accepted criteria like national minimum wages or living incomes. We expect that this kind of contextualization of pricing for green specialty coffee will encourage and even drive important and challenging dialogues the industry must engage in.”

One challenge the Transaction Guide team faced with the latest volume was assembling a substantial report during a pandemic. Peter says the pandemic added complications for data donors collecting information, and the team is thankful they were able to overcome this. “We know that COVID placed enormous pressures on our data donors,” Peter says. “However, the work is very important to all of our supporters and so we are very pleased that the vast majority of companies returned to donate more data. They might have been a bit later than usual, but they were there for us!”

The pandemic also caused the cancelation of an in-person annual meeting and networking opportunity for data donors and the team behind the guide. While the event was supposed to take place in Guatemala in June 2020, it was held virtually instead. “We are assuming that the 2021 annual meeting will also be virtual,” Chad says. “However, we remain hopeful that in the future we will fulfill a key objective of hosting these gatherings in countries where coffee is produced. This will be another opportunity for the sellers and buyers that support—and that benefit from—our work to expand a market of progressive valuations for specialty coffees.”

COVID-19 also had a potential effect on the prices captured in the Transaction Guide, with the median FOB price falling from $2.75 per pound in 2018/19 to $2.60 in 2019/2020. Peter says, “The data tell me that the specialty-coffee world responded to a challenging 2019/2020 harvest by adjusting the composition and timing of their purchases more than by adjusting prices paid for those coffees. Median prices in most quality/quantity buckets were up on the year. However, there was a shift away from fancy and toward more regular specialty coffees. This brought the overall median price down. It also, we think, has implications for how we think about the future of the fancier market segments.”

With these “fancier” coffees typically causing much excitement in the industry, it may be concerning to envision a future where they are less prevalent. For Chad, a shift away from the most expensive categories toward larger lots of lower-quality coffees raises concerns. “This represents a shift that slides closer to commodity and commercial coffee quality and pricing which is then sold as ‘specialty,’” he says. “Further, these fanciest of coffees represent significant additional effort and investment by producers who may now find themselves without an outlet for these premium priced coffees. And those of us who appreciate them may eventually struggle to find these coffees if more roasters are stepping back from them during the uncertainty caused by the pandemic.”

The pandemic has obviously caused ripples throughout the coffee supply chain; Chad says the Transaction Guide team is putting the finishing touches on a dedicated report that illuminates the various specialty market changes induced by COVID-19. The report is expected to be released next month.

The 2020 Specialty Coffee Transaction Guide is now available for download in English, Spanish, and French, and will soon be available in Portuguese.